This paper is part of the blog series on the impact of ASC 606 and how using Oracle Projects can facilitate compliance with the new revenue recognition standards. Previous posts on this subject covered an Overview of ASC 606 and Step 1: Identify the Contract with the Customer. This paper addresses Step 2: Identify the Performance Obligations in the Contract.

This step requires an entity to identify all the distinct performance obligations in a contract or arrangement.

A performance obligation (commonly referred to as deliverables) is a promise to transfer goods or services to a customer. A good or service is distinct when the customer can benefit from said good or service on its own or with resources the customer already has. The good or service can be transferred to the customer independent of other performance obligations in the contract. Goods and services that are not distinct should be combined with other goods or services until the whole group is distinct.

In addition to performance obligations explicitly outlined in a contract, obligations that a customer may expect because of an established business history must be examined. For example, if a vendor has always provided free shipping to a customer, and the customer expects the goods to be shipped for free, the shipping would represent a performance obligation even though it is not explicitly stated in the contract.

How to Determine When a Good or Service is Distinct

To be distinct, a good or service must meet two criteria:

- It must be capable of being distinct, and

- It must be separately identifiable.

The first criterion is similar to the standalone value defined initially in ASC 605. The customer should be able to benefit from the good or service on its own or in combination with other resources it has on hand.

The second criterion is a new concept. The underlying concept in determining whether a good or service is separately identifiable is the notion of “separable risks.” Separable risks relate to whether the risk associated with the obligation to transfer the goods/services is separate from the risk associated with transferring other goods/services. Interpretation of this concept has varied, and the Board decided that entities should evaluate if promised goods/services represent individual promises or inputs in making up a combined output.

The Standard puts forth three factors that may indicate when goods/services are not separately identifiable and should be combined as one performance obligation:

- The entity provides a significant service of integrating the good/service with other goods/services in the contract

- The good/service significantly modifies or customizes another good or service in the contract

- The good/service is highly interrelated or dependent upon another good or service in the contract.

These factors should not be used exclusively to determine if they are separable, and the Board requires judgment by the entity of all facts and circumstances within the contract.

Factors Affecting an Entity’s Evaluation of Performance Obligations

Principal vs. Agent

If other parties provide goods or services to an entity’s customer, the entity must determine whether its performance obligation is to provide the goods/services themselves (Principal) or to arrange for another party to provide the goods/services (Agent). This will determine the amount of revenue that the entity can recognize. If the entity is the principal, it will recognize the gross amount received from the customer. However, if the entity is the agent, it can only recognize the fee or commission received for facilitating the sale. This identification is critical to correctly recognizing revenue in these situations.

Warranties

The new standard now distinguishes two different types of warranties which are accounted for differently. An Assurance-Type Warranty guarantees that the good/service functions as promised and is not a distinct performance obligation. A Service-Type Warranty provides benefits beyond what the Assurance Warranty offers and would create a distinct performance obligation.

Customer Options for Additional Goods or Services

This would pertain to options like customer loyalty points or discounted contract renewals. A distinct performance obligation is created if the option provides a material right to the customer. A material right is not clearly defined but must be more than the standard discount available.

Nonrefundable Upfront Fees

This is similar to a customer option. For example, a customer signs up for a martial arts class with a one-year contract, and an upfront fee is charged. That fee is not required when the customer renews his contract. Because the second year is being purchased at a “discount,” a material right is created and should be accounted for as a distinct performance obligation.

Stand-Ready Obligations

This can happen either through contract specifications or customary business practices. This happens when an entity is required to have services ready whenever a customer decides to use them. An example would be a 24-hour health club. Revenue received is recognized over the period an entity offers the stand-ready service.

Rights of Return

A right of return obligates a customer to accept the product should it be returned. This adds variability to the transaction price and should be considered when evaluating variable consideration.

Using Oracle Projects to Meet The Objectives of Step 2 of ASC 606

In our previous paper, we described three types of contracts typical to service delivery organizations:

Service Contracts based on selling hours (Time & Expense-“T&E”): In this scenario, the delivery organization contracts to provide a specified number of hours of specialized resources that will deliver to the client’s requirements. There are no specific deliverables listed in the contract. These contracts are slowly disappearing as clients demand more specifics before signing contracts.

- Pure Professional Service Organizations (“PSO”) – Management Consulting

Time & Material (“T&M”) Service Contracts based on specific Deliverables AND Fixed Price Service Contracts based on Milestones: These are very typical service contracts. They are combined here even though they have completely different billing methods because they will need to be treated the same for revenue recognition purposes under the new standard. Additional contract types like Cost Plus or some variant of this with different fees will also fall under this category for Revenue Recognition as long as these contracts specify specific obligations/deliverables on the service provider.

- PSOs, Engineering, IT Services, Marketing/Advt. Services

Unit Price-Based Contracts: Commonly referred to as Schedule of Values (SOV) contracts. These contracts typically specify the number of units to be delivered for one or more types of items after an initial design/confirmation period.

- Construction, ATO/ETO-based Manufacturing Firms.

- SOV functionality is introduced in release 12.2.5.

We will continue to Step 2 using the case studies previously discussed.

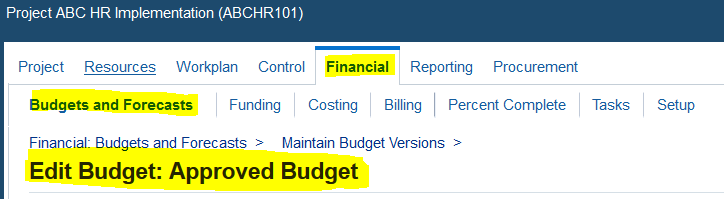

Service Contracts Based on Selling Hours (T&E)

Budget for the contracted number of hours.

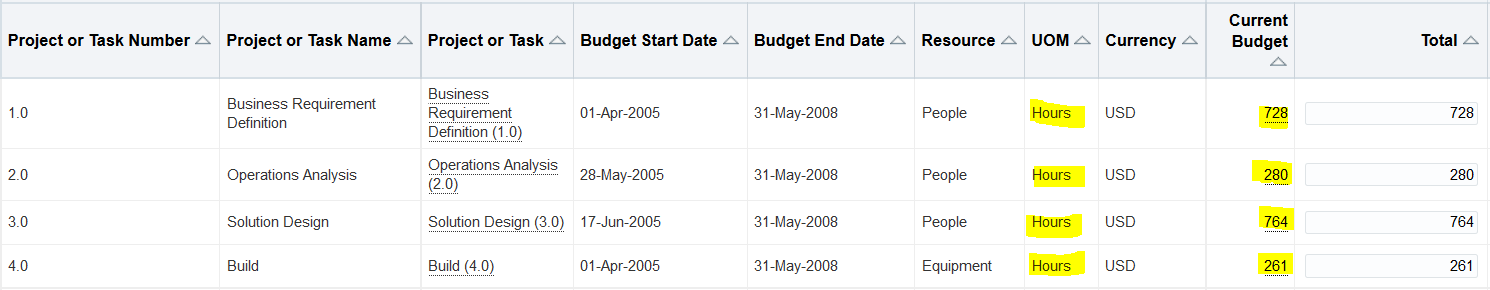

Time & Material Service Contracts AND Fixed Price Service Contracts

Enable and set up deliverables for each performance obligation.

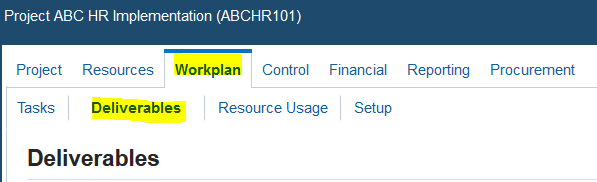

Unit Price-Based Contracts

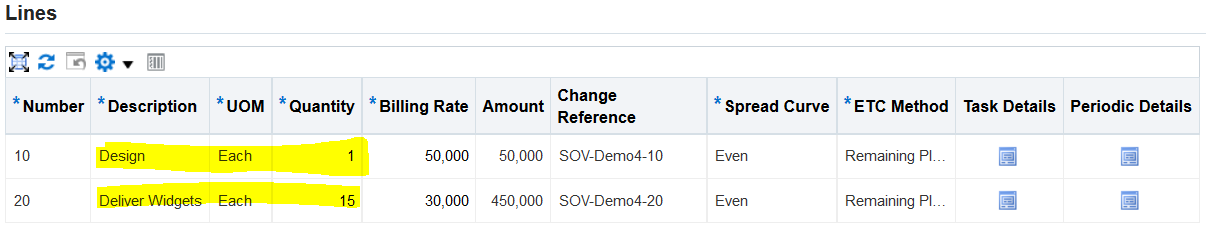

Enable Schedule of Values (“SOV”) lines with the Type and Number of each contracted item.

As you can see, Oracle Projects provides the ability to configure your projects to meet the requirements of Step 2, Identify the Performance Obligations in the Contract, of the new ASC 606 guideline with standard functionality. Our next series blog will cover Step 3: Determine the Transaction Price and Step 4: Allocate the Transaction Price.

Oracle Licensing Requirements

- Project Costing and Billing are required for all features discussed in this paper.

- Project Planning and Control must be implemented to leverage Deliverable functionality.

- The schedule of Values functions is available in Oracle Project Planning and Control release 12.2.5.

Up next – Step 3: Determine the Transaction Price – Revenue Recognition Standards

Learn more on managing ASC 606 revenue recognition with Oracle EBS Projects-

Read the white paper

View the presentation

Questions?

Contact Us!