Authored by: Wendy Lamar | Managing Principal Consultant | Project Partners

Authored by: Wendy Lamar | Managing Principal Consultant | Project Partners

Oracle E-Business Suite R12 Project Certified Implementation Specialist

Subledger Accounting (SLA) controls the creation of journal entries by accepting the accounting events entered in sub-ledger applications and interfacing with General Ledger. SLA allows configuring the delivered accounting events to modify the accounting interfaced from the sub-ledger applications, such as overriding individual segment values in the account combinations. In addition, you can utilize SLA to assign additional journal lines to the accounting event and interface those to General Ledger.

Many companies will want to account for the Burden portion of the Total Burdened Cost amount separately from the Raw Cost Amount basis. However, they chose to implement Total Burdened Costing instead of Burden as a Separate Expenditure Item because they wanted to apply burden to their forecast financial plans. Therefore, only the Total Burdened Cost is supported for automatic calculation in the forecasting functionality for burdening the forecast.

Subledger Accounting is utilized to offset the raw cost amount from the Total Burdened Cost journal entry to accommodate this requirement. Because Subledger Accounting allows the creation of additional journal lines with an existing accounting event, but the amount cannot be overridden, the offset to reverse the raw cost amount from the journalized total burdened cost amount is accomplished by creating additional journal lines on the basic cost journal entry. This other journal will be generated in Subledger Accounting, not in Projects. Therefore, the configuration is completed in SLA; there is no configuration impact on Project Auto Accounting.

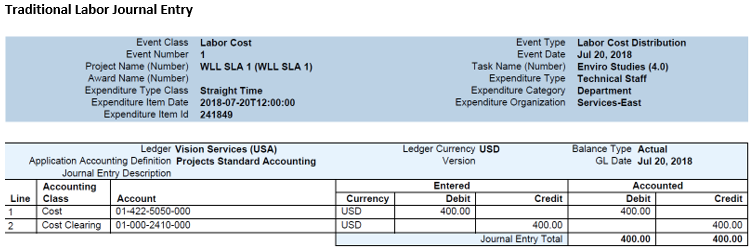

The following example is a modification to the sub-ledger accounting rules for the Labor Cost.

(These adjustments would need to be made to the appropriate raw cost and raw cost adjustment event classes per individual implementation requirements based on the types of costs where the burden is applied.)

When the Subledger Accounting event class for Labor Cost is not modified, it will accept your accounting event based on auto-accounting built account combinations for the labor cost and labor cost clearing definitions. The same applies to the Total Burdened Cost event class.

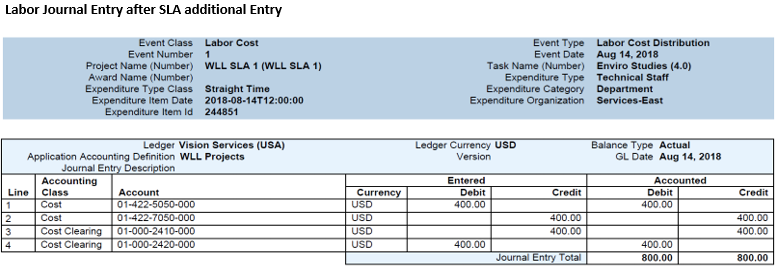

When you modify the labor cost event class, the resulting accounting events will include the additional journal lines per your definitions. Our example modifies the labor cost event class to offset the labor cost amount against the total burdened cost account combinations for burdened cost and burdened cost clearing.

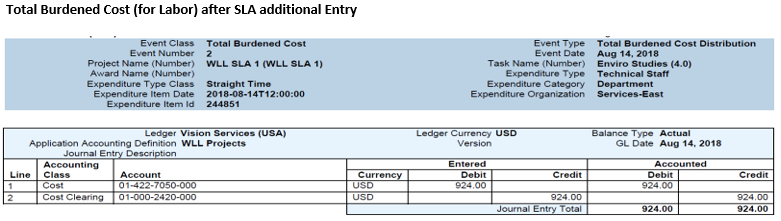

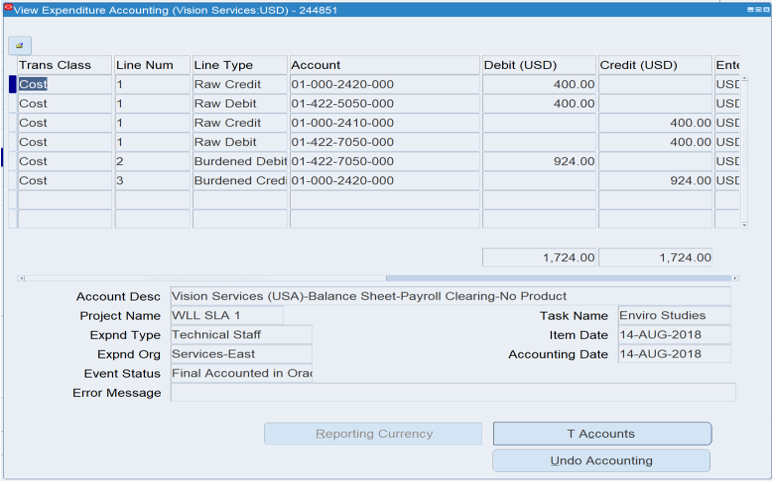

After processing both labor and total burdened cost entries, the NET result is:

DR Labor Cost 01-422-5050-000 400.00

CR Labor Cost Clearing 01-000-2410-000 400.00

DR Total Burdened Cost 01-422-7050-000 524.00

CR Total Burdened Cost 01-000-2420-000 524.00

This result accounts for 400.00 to raw labor cost accounts and the additional burdened amount of 524.00 to load cost accounts. Without the other journal lines on the labor accounting event, raw labor cost would be accounted for 400.00, and the burden accounts would be accounted for 924.00.

Again, the offset is assigned to the raw cost event class and not the total burdened cost event class because the event class can create additional journal lines and assign different account combinations. However, it cannot assign a different line amount to the journal lines.

The updated accounting lines are viewed by looking at the view accounting menu option from Expenditure Inquiry. These additional lines cannot be considered in the cost distribution lines.

The following example is provided to configure this solution, which assigns the additional journal lines to the raw labor cost event class.

The following example is provided to configure this solution, which assigns the additional journal lines to the raw labor cost event class.

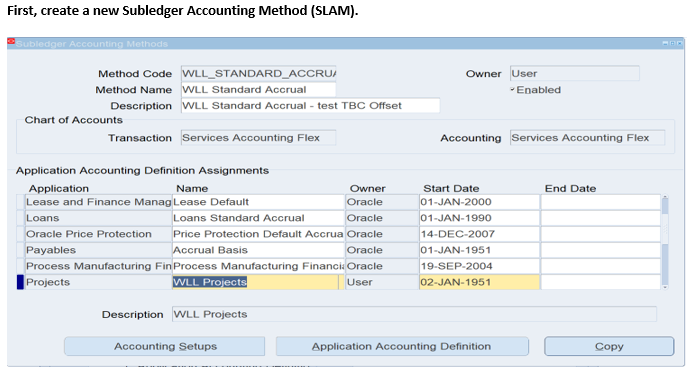

TIP: The document lists the configuration from the top sub-ledger accounting method (SLAM) to the lowest levels of the supporting configurations. The hierarchy is as follows:

Subledger Accounting Method

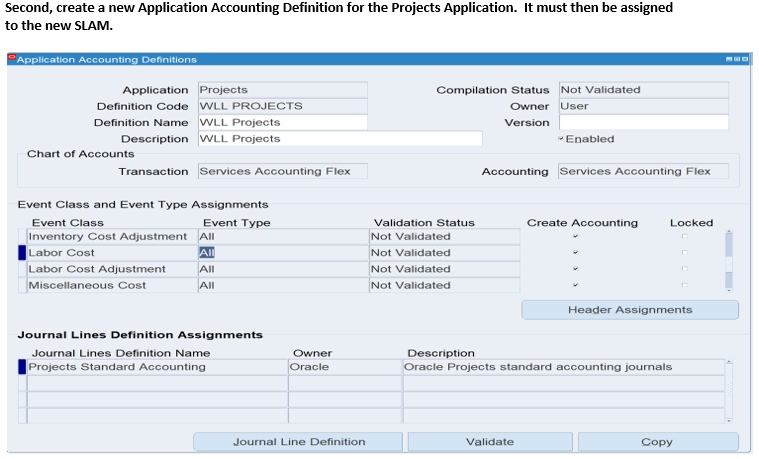

Application Accounting Definition

Journal Line Definitions

Journal Line Types

Account Derivation Rules

Optionally, you can create custom sources to derive segment values using PL/SQL functions if the configurable options do not meet your needs.

The SLAM should be assigned to the ledger once all configurations are completed. Also, ensure the Application Accounting Definition is validated.

Setup > Subledger Accounting > Accounting Methods Builder > Methods and Definitions > Subledger Accounting Methods.

Next, create a new Journal Line Definition and assign Journal Line Types. In addition, Account Derivation Rules are assigned to the Journal Line Types.

Next, create a new Journal Line Definition and assign Journal Line Types. In addition, Account Derivation Rules are assigned to the Journal Line Types.

The Journal Line Definition is the accounting event that will result from the transaction. Our example follows Labor Costs. Within the journal line definition, multiple journal line types are assigned for each resulting journal line. In addition, each journal line type is assigned account derivation rules which determine the account combination derived.

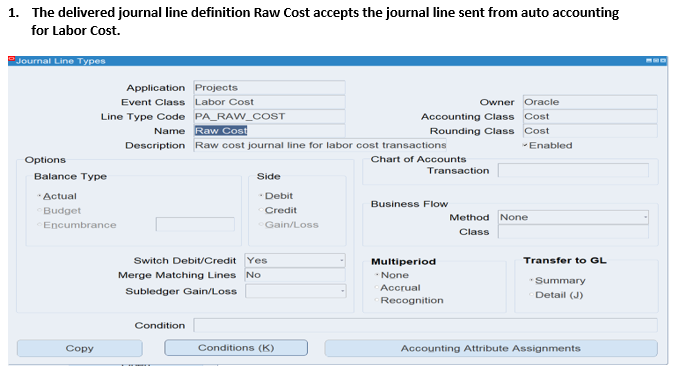

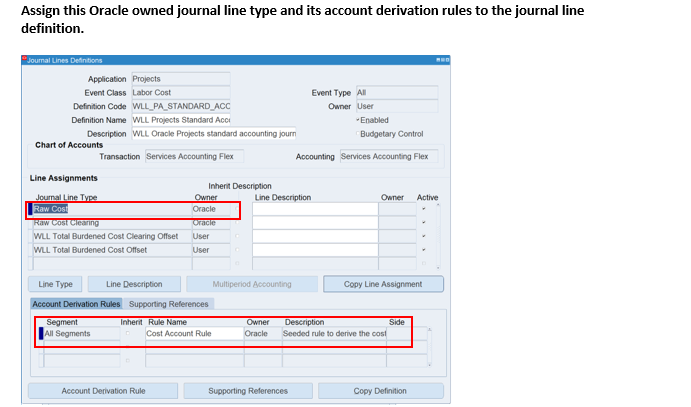

**Ensure you first add the standard Oracle Raw Cost and Raw Cost Clearing journal line types and assigned account derivation rules. This follows the standard Oracle definition to accept the debit and credit lines interfaced as the accounting event from Oracle Projects.

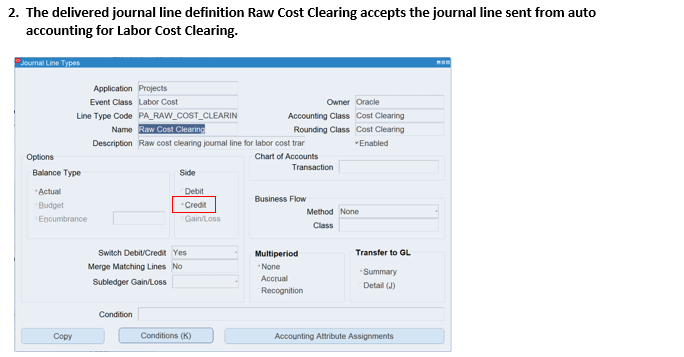

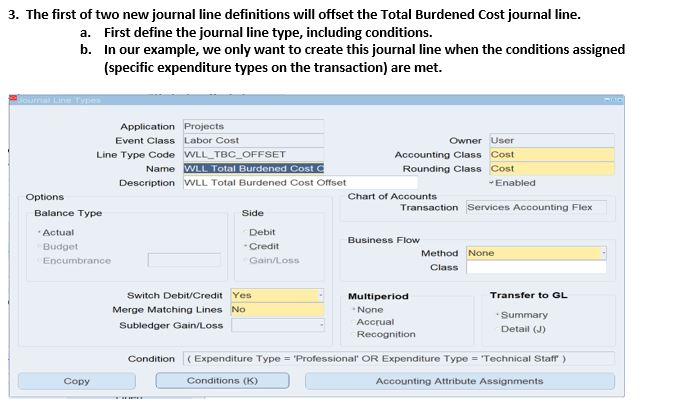

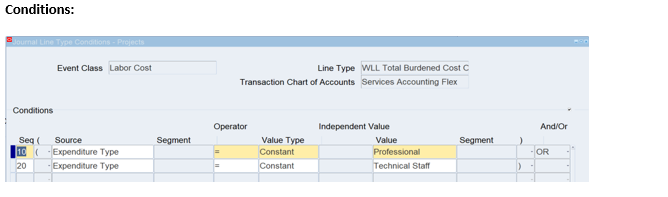

The first new journal line type will be for the Total Burdened Cost offset. This journal line definition will create an offset journal line to reverse the journal entry debit for Total Burdened Cost in the amount of the raw labor cost. In this example, only the natural account will differ from the segments charged in the source labor cost journal line. To accomplish this, we will create a journal line definition that accepts all segments except for an override for the natural account segment.

TIP: Copy the Raw Cost rule and switch from Debit to Credit.

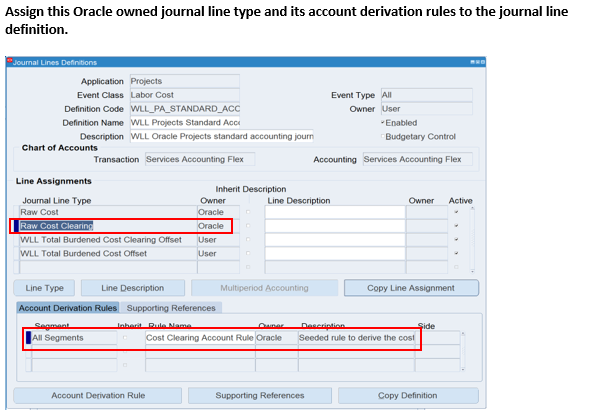

The second new journal line type will be for the Total Burdened Cost Clearing offset. This journal line definition will create an offset journal line to reverse the journal entry credit for Total Burdened Cost, clearing the raw labor cost amount.

TIP: Copy the Raw Cost rule and switch from Credit to Debit.

Four journal line types will be created to accomplish the resulting four journal line accounting event.